The Full 2026 VC AI Predictions: where Menlo, a16z, Bessemer, Khosla, A16Z see the opportunities in 2026

The most comprehensive breakdown of where top VCs in the wold see the opportunity for 2026

Hey everyone,

Happy new year! 🥳

Today we’re breaking down what top VCs actually believe will matter in 2026. It won’t be about bigger models or better demos, but what AI is judged on whether it actually works inside real companies.

Across top venture firms (Menlo, a16z, Bessemer, Khosla, A16Z), a clear set of predictions is emerging:

agents move from tools to employees

tiny teams reach outsized revenue

interfaces shift to voice and multimodal

CFOs become the real buyers of AI

Here’s what we cover in this edition:

Why agents stop being apps and start being employees — with budgets, permissions, and outcome-based pricing

How tiny teams reach outsized revenue as AI decouples growth from headcount

Why interfaces shift to voice and multimodal, and what that unlocks in real workflows

Why 2026 becomes the ROI payback year, with CFOs replacing users as the real buyers

Which verticals unlock the next wave of AI adoption, with finance emerging as the clearest opportunity

How exits, valuations, and founder incentives shift as discipline returns to the market

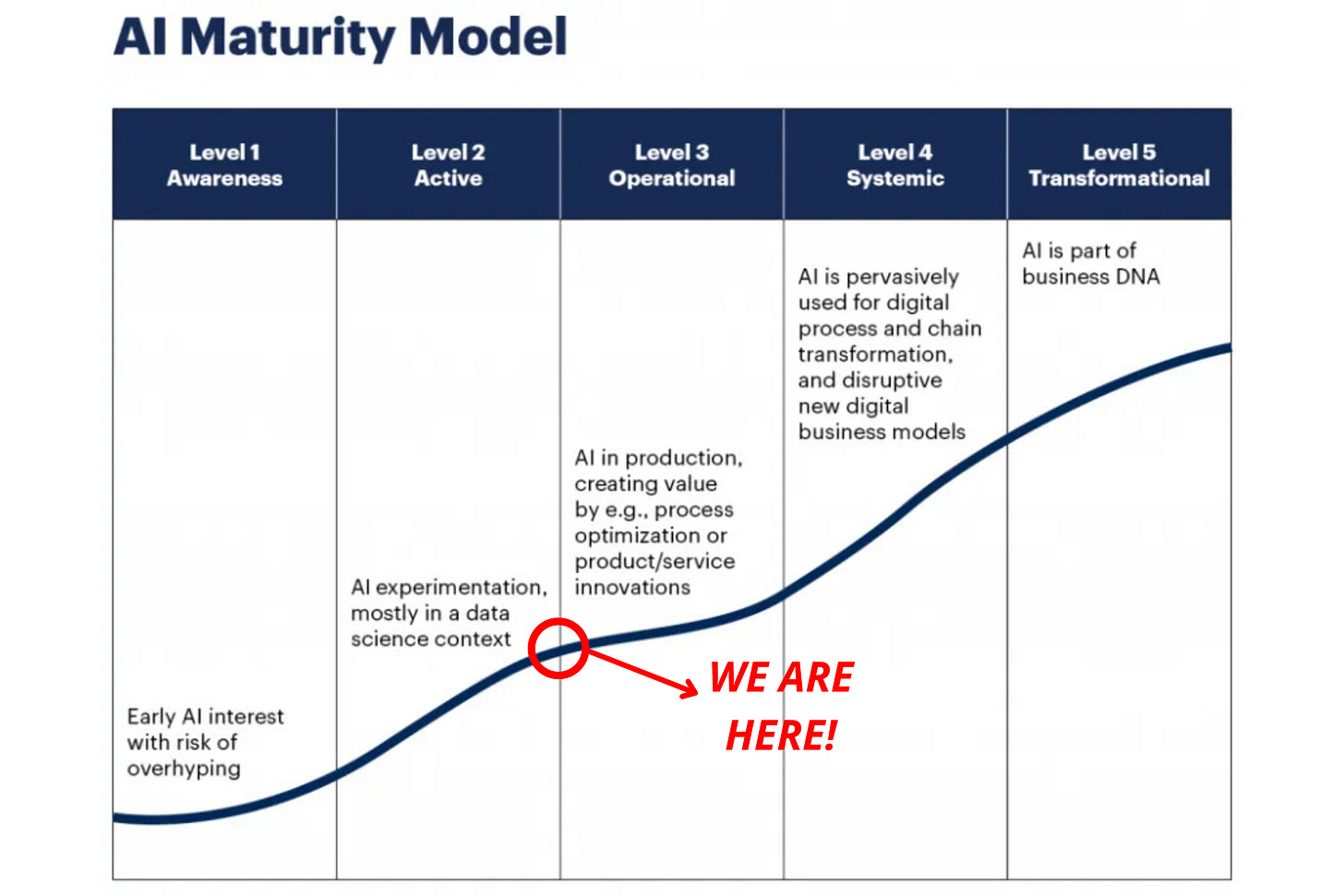

Where we actually are on the AI maturity curve

TL;DR:

2026 is the year AI stops being impressive and starts being accountable.

Top VCs agree on one thing: The next wave of winners won’t be decided by model quality, but by who can operationalize AI inside real companies.

Lets get to it 🔥

Want to Sponsor The AI Opportunity & get your product in front of thousands of founders worldwide? Reach out to g@guillermoflor.com

Trending right now: The Data Room Template VCs love, 27 Most Promising AI Startup Pitch Decks Backed by Top Investors in 2025

1. Agents become employees (not apps)

Cathy Gao (Sapphire Ventures): agents get job titles, budgets, limits; pricing shifts to “work done”

What’s really being predicted is a procurement + governance shift.

Once an agent can take real actions (refunds, purchases), buyers need controls: permissions, spend caps, audit logs, escalation rules.

That pushes pricing away from “$ per seat” toward $ per outcome (tickets resolved, dollars recovered, invoices processed).

Winning companies will look less like SaaS and more like managed labor with measurable throughput.

A central orchestrator (the “manager”) breaks work into tasks, assigns it to specialized agents, monitors execution, and escalates when needed.

Worker agents don’t decide what to do. They execute within limits, using approved tools.

This structure is what makes governance possible: permissions, spend caps, audit logs, and human override. Without it, autonomous agents can’t safely operate in production.

Once work is orchestrated and outcomes are measurable, pricing naturally shifts from per-seat software to paid-for throughput.

The prediction is that winning AI companies look less like SaaS, and more like managed labor platforms.

Lindsey Li (Bessemer): “code clean-up agents” emerge to refactor messy AI code

This is the technical-debt hangover of 2024–2025.

A ton of AI-generated code shipped fast, but now teams face maintenance pain: inconsistency, unclear patterns, “nobody owns it.”

A new category appears: agents that do refactoring, debugging, test generation, dependency upgrades, codebase standardization.

If you’re building here, the product is “AI maintainer” plus trust hooks (tests, diffs, rollbacks, CI integration).

Tomasz Tunguz (Theory Ventures): workers manage ~50 agents daily (soon)

This implies a new job: agent manager.

The bottleneck stops being “can AI do tasks?” and becomes “can humans reliably direct, monitor, and approve 50 parallel workers?”

Big opportunity: agent orchestration layers (routing, priorities, budgets, memory, evaluation, approvals).

Expect “agent operations” to become a real function the way DevOps did.

2. Tiny teams + extreme output

Brian Bustamante-Nicholson (Greycroft): “do more with less” keeps accelerating

This is basically “AI compresses the marketing and creative org chart.”

Remote work already shrank teams. Now AI reduces reliance on agencies and internal headcount for creative, content, performance iteration, and campaign ops.

The direct effect: longer runway and more experimentation per dollar.

The second-order effect: startups can pivot faster because switching cost is lower.

Jared Heyman (Rebel Fund): very small teams can hit huge ARR (even ~$100M+)

This is a bet on distribution + automation being the real scaling engine.

If product creation, support, and parts of sales are automated, the team doesn’t grow linearly with revenue.

For this to be true, you usually need: product-led distribution, narrow ICP, strong retention, and a workflow that is easy to onboard.

Translation: 2026 rewards companies that turn “AI leverage” into unit-economics leverage.

3. The interface shifts: voice, video, multimodal

Manthan Shah (WestBridge Capital): voice becomes a platform

Voice isn’t just a UX change. It’s a workflow change.

Voice removes friction in “real-time work” where typing is unnatural: sales, support, field service, healthcare, logistics.

If voice gets good enough, products feel less like software and more like a colleague.

The wedge: voice systems that plug into data + actions (CRM updates, ticketing, scheduling).

This is a continuation of a theme we’ve already explored.

A few months back, we already broke down the potential billion-dollar opportunity in Voice AI, specifically how licensed voice (and image) rights unlock voice as a production-ready, enterprise-safe asset, not just a UX feature.

If you want the full framework on where the money sits in voice, you can read it here:

This piece explains why voice only becomes powerful at scale once it’s legally ownable, controllable, and deployable inside real workflows, which is exactly what enables the shift from “software” to “colleague.”

Simon Wu (Cathay Innovation): enterprises move from text-only to “listen + see”

This is the “multimodal goes operational” call.

Voice becomes default in support/sales/service because it maps to human processes.

Video becomes critical infrastructure for robotics, field ops, analytics because it turns the physical world into data.

Expect “multimodal intelligence” to be positioned as a defensible advantage (not just a feature).

4. ROI reality (the 2026 “payback” year)

Venky Ganesan (Menlo Ventures): “show me the money” year; some AI companies hit severe issues

This is the renewals + CFO moment.

Enterprises keep what produces measurable savings or revenue, and cut the rest.

AI companies that scaled spend ahead of proof will face down rounds, churn, or worse.

The bar becomes “prove ROI in a board-friendly way,” not “cool demo.”

Medha Agarwal (Defy.vc): pilots get delayed/scaled back/canceled without hard returns

This is how the ROI shift shows up inside big companies.

Many orgs ran pilots because budgets were available and fear of missing out was high.

In 2026, pilots must convert into scaled deployments or they die.

The hidden requirement: integration + change management, not model quality.

Rob Biederman (Asymmetric Capital Partners): Must-have ROI vs nice-to-have gap widens

This is a portfolio-sorting year.

“Nice-to-have” tools get squeezed by budget scrutiny.

Products with clear payback win renewals and expand.

Practically: buyers will ask “what metric moves?” and “how fast?” before they ask about features.

5. The next big vertical: finance

Rajeev Dham (Sapphire Ventures): “Harvey for finance” hasn’t been built yet

The point: finance is huge, standardized, and still painfully manual.

Legal got a breakout “AI-native workflow company.”

Finance is next: close, reporting, audit prep, variance analysis, reconciliation, controls.

Big opportunity because ROI is easy to explain: time saved + errors reduced + faster close.

Lindsey Li (Bessemer): Excel becomes a breakout AI wedge

Excel is where work actually happens.

It’s structured enough for AI to help (tables, formulas, logic).

It’s manual enough to be painful (cleanup, consolidation, reporting).

Products that feel like “Excel autopilot” can spread fast because they live in an existing habit.

6. Founder and labor market dynamics

Sheena Jindal (Sugar Free Capital): technical depth becomes premium; acquihires keep driving outcomes

This is a bet on the talent market as an exit market.

If big tech/frontier labs pay up for elite teams, early investors can get liquidity earlier via acquihires/M&A.

It pulls founders toward building “breakthrough teams” even if they don’t build enduring companies.

It also increases the premium on founders who can ship research-grade capability into product.

Sarah Du (Uncork Capital): founders skew younger because speed matters more than tenure

When the platform shifts fast, experience matters less than learning velocity.

First-time founders can compete because nobody has “20 years of agent experience.”

Younger founders often move faster and iterate more aggressively.

The advantage becomes taste + execution speed + technical ability, not resume.

7. Social backlash

Ethan Choi (Khosla Ventures): white-collar anti-AI protests

This is the “AI becomes political” moment.

Disruption hits knowledge workers directly, not just repetitive manual labor.

Expect pressure for regulation, transparency, and job protection in some markets.

For startups: compliance, auditability, and “human in the loop” become selling points, not constraints.

8. Liquidity: IPOs, M&A, acquihires

Tamara Steffens (Thomson Reuters Ventures): IPO window continues to open

This is macro + backlog.

There’s pent-up demand for liquidity from early investors.

If markets stay stable, more companies will test the waters.

IPO readiness becomes a strategic asset again.

Brian Bustamante-Nicholson (Greycroft): marquee IPOs (like SpaceX) can “open the gates”

This is about sentiment and comparables.

A big successful IPO resets public comps upward and makes “going public” feel viable.

That can force strategics to acquire sooner instead of waiting.

It also pressures late-stage private pricing to align with public reality.

Tomasz Tunguz (Theory Ventures): mega-acquihires accelerate

Talent is the scarce input.

Big companies buy teams to secure capability faster than hiring can.

Expect more deals that look like “acquisition as recruiting.”

Startups that are “great team + unique capability” become liquid even without huge revenue.

Sarah Du (Uncork Capital): founders may build for acquisition

This is the rational response to the acquihire market.

Some teams will optimize for: sharp technical edge, clear demos, strategic fit.

It changes company strategy from “10-year independent giant” to “build something buyers must own.”

For investors, it changes expected time-to-liquidity.

9. Valuation correction

Deedy Das (Menlo Ventures): AI valuations get marked down; comp gets squeezed

This is what happens when pricing outruns fundamentals.

If revenue doesn’t catch up, valuations reset.

When valuations reset, employee equity becomes less exciting, and hiring gets harder.

The “best” still win, but the middle gets exposed.

Nnamdi Okike (645 Ventures): discipline returns; correction ripples across the AI stack

This is the “downstream contagion” view.

If foundation-model and hyperscaler narratives cool, it hits infrastructure, then apps.

Investors start underwriting with stricter payback assumptions.

Consequence: fewer “story rounds,” more “metrics rounds.”

Ethan Choi (Khosla Ventures): private valuations look unsustainable without explosive revenue

Same correction thesis, stated more bluntly.

The gap between pricing and revenue can’t keep widening forever.

2026 tests which companies have real demand and retention.

This pushes the ecosystem toward M&A if IPOs don’t absorb the backlog.

10. Consumer agents, companionship, and “production”

Shawn Carolan (Menlo Ventures): personal agents become essential in daily life

This is “agents move from tasks to autonomy.”

Not just booking, but negotiating, canceling, managing subscriptions, planning multi-step workflows.

The key issue becomes trust: “how much control do I want to delegate?”

Products that win will own identity, permissions, and the action layer.

Medha Agarwal (Defy.vc): AI companionship becomes socially normal

This is a cultural adoption call.

People stop hiding usage and start talking about AI relationships openly.

That unlocks consumer distribution and retention patterns we haven’t seen since social.

The winners will nail safety, boundaries, and emotional UX, not just intelligence.

Mo Jomaa (CapitalG): 2026 is “agents in production” if infrastructure catches up

This is about reliability.

Demos are easy. Production requires: evaluation, monitoring, fail-safes, tool permissioning, latency, cost control.

If infra improves, agent adoption jumps from pilots to real deployments.

If infra doesn’t, agents stay fragile and stalled.

11. Data becomes the gold rush

Matt Murphy (Menlo Ventures): training data market explodes (next 100 verticals)

This is the “data is the new bottleneck” view.

As models specialize, the limiting factor becomes high-quality, domain-specific data and evals.

New markets form around collecting, labeling, verifying, and maintaining training sets.

Risk: overfunding early verticals, then a shakeout.

12. Startup formation surges

Aaron Holiday (645 Ventures): coding tools lower barriers, startup birth rate soars

This is “software creation gets democratized.”

More people can ship without a traditional engineering team.

More experimentation happens because cost of building drops.

Net: more startups, faster iteration, more noise, and a bigger premium on distribution.

13. Extra Khosla specifics (Ethan Choi)

Robotics gets a GPT-3 moment

A foundational capability leap in robotics models, enabling more general-purpose physical-world tasks.

Vibe-coding may lose steam

If it doesn’t translate into durable consumer behavior or enterprise value beyond prototyping.

Exits tilt to M&A if correction hits

“More M&A than IPOs,” even if the strongest can still go public.

Names an IPO candidate

Mentions Grayscale first, plus Ethos and Klook.

Company building changes

PM role pressured as engineers + AI absorb more customer synthesis and roadmap driving; sales gets leaner with AI support.

A16Z Predictions

Each year, a16z partners publish their “Big Ideas” for the next 12 months, calling shots on where tech founders will take us next.

Our friends across the firm have already published a three-part series featuring Big Ideas from partners on Bio + Health, American Dynamism, and Crypto.

Today, 14 investors and operating partners on the a16z speedrun team weigh in with their own Big Ideas for 2026.

1) AI world models will take the spotlight in storytelling

By Jonathan Lai - X | LinkedIn

World models will also likely give rise to not just a single game, but an entire new category of generative world experiences. You could have a horror experience where you’re hiding from generated monsters, or a D&D experience where you’re roaming an infinite fantasy world with friends.

2) Venture capital will eat private equity

While the west coast, Patagonia-wearing VCs and the east coast, PE suits used to live in different universes… In 2026 with AI, I believe, those worlds converge.

3) Multi-player AI will eat single-player AI

By Fareed Mosavat - X | LinkedIn

Right now, most AI tools are built for one human + one model in a private workspace. ChatGPT, Cursor, Claude. Incredibly powerful, but currently optimized for individuals. The impact is massive: drafts, code, specs, campaigns, workflows. But almost none of it is shared, aligned, or contextualized across a team.

4) Pricing will become earned, not negotiated

Say you need 50 qualified sales meetings. Instead of buying another AI tool, you post a bounty: “$500 per meeting booked.” AI agents compete. Whoever performs best gets paid. We already do this with bug bounties, Kaggle, hackathons. Why not for AI agents going after real business outcomes?

5) The first AI-native university

By Emily Bennett - X | LinkedIn

Picture an institution where courses, advising, research collaboration, and even building operations continuously adapt based on data feedback loops. Schedules optimize themselves. Reading lists evolve nightly and rewrite themselves as new research appears. Learning paths shift in real time to meet each student’s pace and context.

6) The world will begin to optimize for ME

For over two centuries, our world has been shaped by one idea: economies of scale. This mindset delivered extraordinary progress: affordable/accessible nutrition, reliable housing, global transportation (and the accompanying shrinking of supply lines and cultural divides), and more. But in 2026, I believe this paradigm flips.

7) The hacker house will professionalize

Ambition breeds ambition, and society needs ways to get the smartest and hungriest young people in a single room together. Residencies are one of the cheapest and most effective ways to create this clustering / cohesion—the expansion of solo founding / building only heightens the need for cohesive communities

8) The return of well-paid writers

The word on the street is that the kids don’t read anymore. Everybody overdosed on YouTube Shorts and Bang energy drinks and forgot how to flip a page. So the story goes. But something strange is starting to happen. Startups are talking about wanting to hire “storytellers.”

9) Curation, not content, will be king

The best movie/game/book recos I’ve gotten came from word of mouth or short-form videos, which led me to YouTube, which I then consumed while then going to Reddit to discuss. As cliche as it sounds, can AI solve this? An ‘agent of my tastes’ recording the things i consume and suggesting the most relevant pieces of media worth spending my time on.

10) AI-native marketplaces will work for the buyer

This past year, I’ve had a front-row seat watching teams at a16z speedrun build AI agent companies across legal, logistics, manufacturing, and other complex, operational domains. What’s striking isn’t just how capable these agents are, it’s that they already take responsibility for outcomes, not just information. Seeing that up close has changed how I think about e-commerce.

I’ve spent much of my career around marketplaces and the classic playbook was powerful: bring fragmented supply online, aggregate it in one place, make it easy to search, and reduce friction at checkout.

11) Fat AI startups will own the slowest markets

Back in 2010, Ben Horowitz said some startups should go fat—build the full stack, own distribution, and move fast—while Fred Wilson preached lean. Fifteen years later, the debate’s settled: in the AI era, fat startups win. A fat startup ships outcomes, not features. It bundles software, data, hardware, and human ops into one integrated product that actually gets the job done.

12) AI will become a “civilization” level technology

By Marcus Segal - X | LinkedIn

Predictive health could transform the health insurance industry from a cost of treatment model to a cost of prevention model. Smart cities powered by AI that integrates traffic, utilities, school and safety data to create better urban environments. Natural disaster prediction and remediation planning to save lives and trillions of dollars.

13) We’ll develop tools that help us stay human

By Lejla Johnsen - X | LinkedIn

AI is doing the grunt work so we can finally master human work. This speed of change is pushing us toward what truly matters: self mastery. We can’t control the external, but we can strengthen our internal operating systems by using tools that scale emotional intelligence, foster faith, and bridge the isolation AI risks creating.

14) The coming consumer AI renaissance

I’m especially excited about products that use AI to make previously expensive services cheaper and more accessible, sometimes using human-in-the-loop to start. This includes things like AI travel agents, personal assistants, matchmakers, therapists, tutors, and more.

Where we actually are

Most companies today sit between Level 2 (Active) and early Level 3 (Operational) on the AI maturity curve.

AI has moved past experimentation, but it isn’t yet systemic.

It runs in production in narrow workflows, with uneven reliability, limited governance, and unclear ownership.

That position explains everything playing out in 2026:

Agents start resembling employees because production requires accountability.

Tiny teams scale because automation only compounds once workflows stabilize.

Voice and multimodal interfaces matter because real work isn’t text-native.

CFOs step in because Level 3 forces AI to justify cost with outcomes.

Level 4 adoption (where AI reshapes organizations end-to-end) remains rare.

Level 5 is still theoretical.

2026 is the sorting year between companies that cross into operational AI and those that stall at pilots.

The difference won’t be model quality. It will be governance, integration, and economic proof.

What actually changes if you’re building in 2026

The implications of these shifts are practical, not abstract.

If you’re building an AI company going into 2026:

You’re no longer selling software access.

You’re selling work done. Buyers will ask what output you replace, how reliably, and at what cost.Governance isn’t a feature — it’s table stakes.

Permissions, audit logs, spend controls, and human override aren’t “enterprise nice-to-haves.”

Without them, you don’t reach production.Distribution matters more than raw capability.

The winners embed where work already happens (Excel, CRM, finance systems), not where demos look good.ROI must be provable within one budget cycle.

If value isn’t visible to finance in months, not years, renewals get cut.Teams that feel small will outperform teams that look big.

AI leverage compounds only once workflows stabilize — not during experimentation.

In other words:

2026 rewards teams that design for operations, accountability, and economics from day one.

That’s it for our roundup of the a16z speedrun team’s Big Ideas for 2026. Have thoughts you’d like to share? Hit us in the comments below.

For more weekly dives into the world of early stage startups, subscribe below.