Sh*it, are we in a bubble? - 10 Things You Need to Understand About the OpenAI Bubble

Had to read about this and it's not looking good. OpenAI circular financing is looking like a bubble about to burst

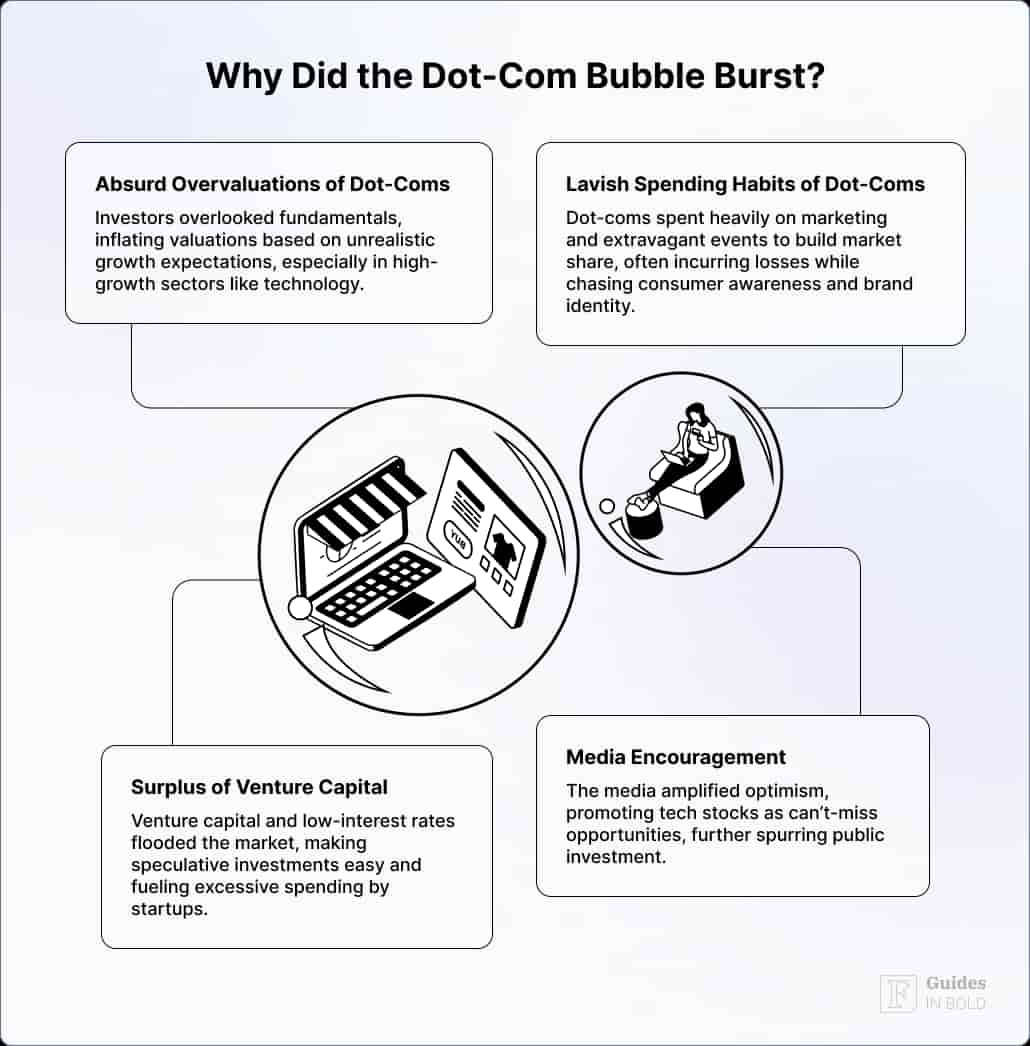

First, why did the Dot-Com Bubble burst

The AI Opportunity is read by top investors worldwide. Sponsor at g@guillermoflor.com

Sounds familiar?

The AI boom is unlike anything we’ve seen since the dot-com era.

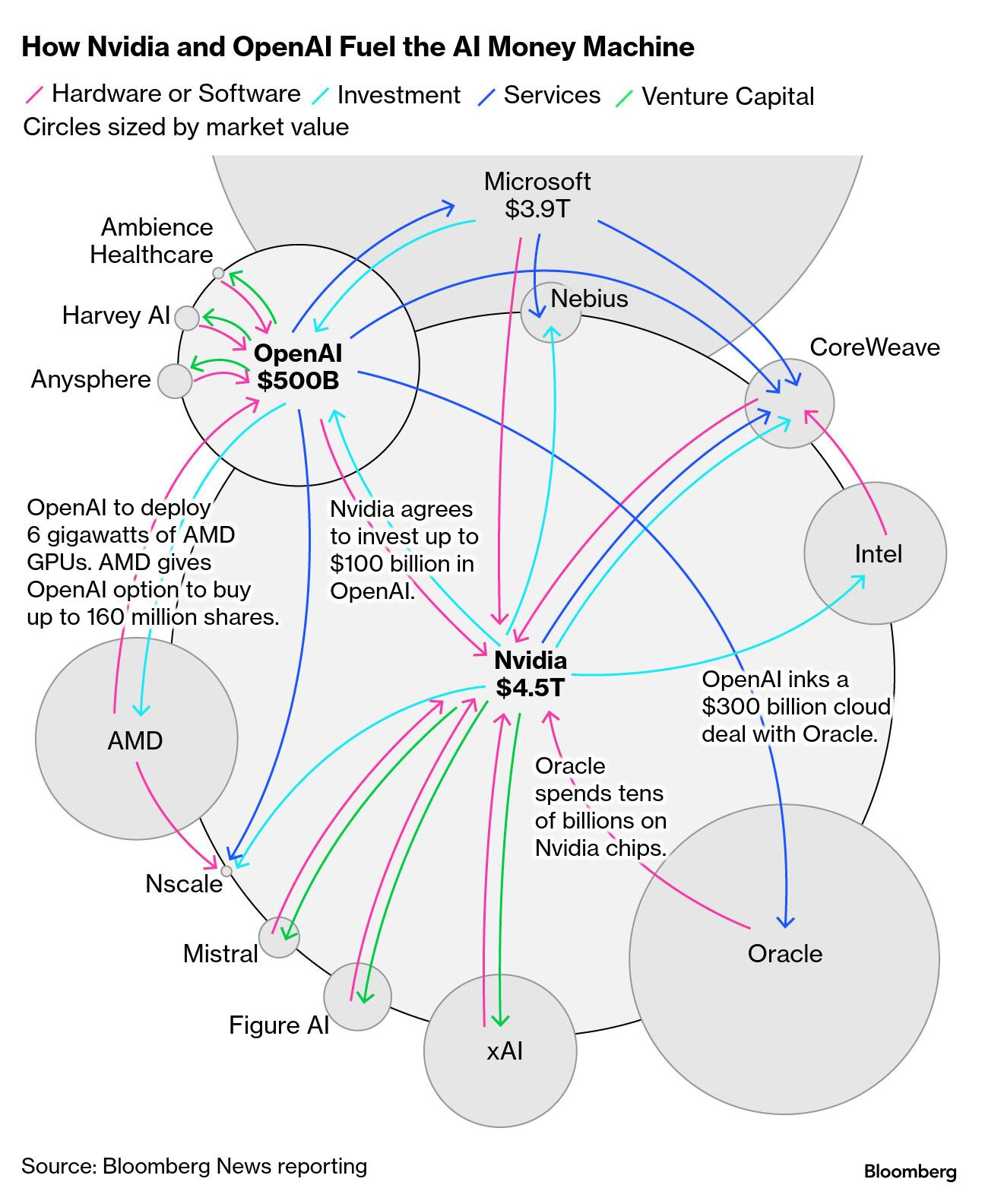

But behind the trillion-dollar valuations and GPU shortages lies something stranger: the same companies funding and selling to each other.

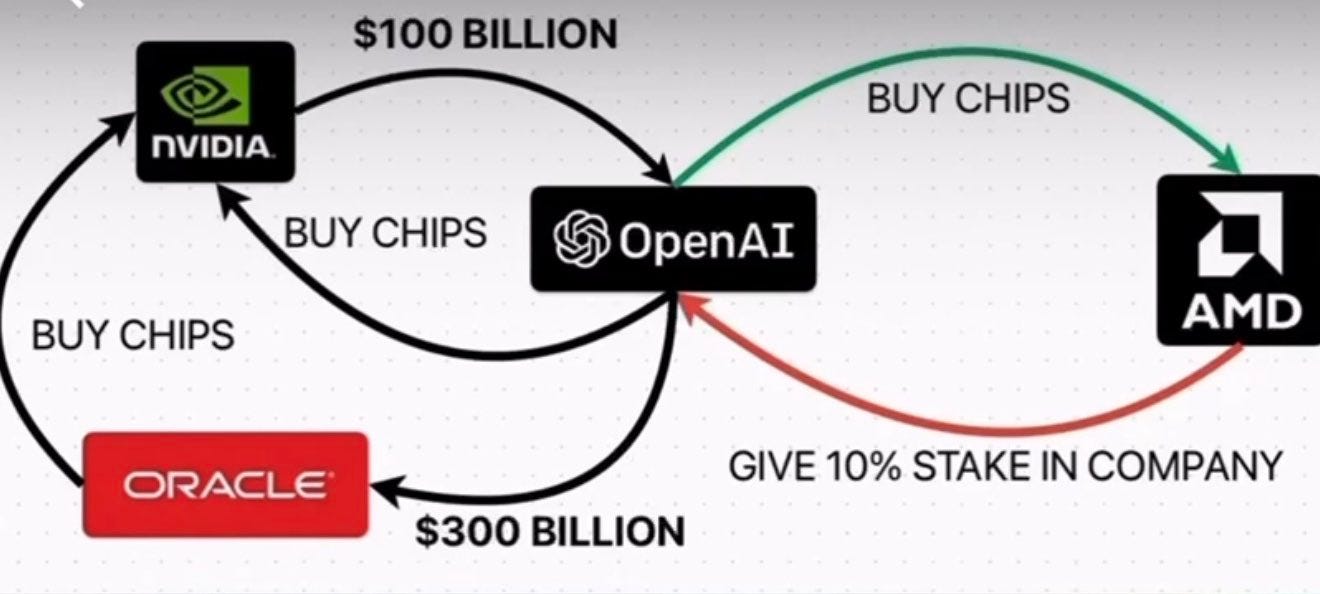

When Nvidia invests $100 billion in OpenAI—only for OpenAI to spend that money buying Nvidia chips—we’ve entered what Morgan Stanley calls “circular financing.”

It’s the moment the AI economy starts eating its own tail.

Here are the ten things you need to understand before calling this “just another tech cycle.”

1. The AI economy is now a closed loop

Broadly, circular financing in AI means money and technology flowing in loops among a few key firms. Instead of a straight vendor-customer chain, each party becomes both investor and client. In practical terms: one company will take an equity stake in another, which then spends cash buying products from its investor.

Think of it like a closed-loop deal: “lend me $20 so I can buy your beer,” to use a quip some analysts have paraphrased. Critics say this has echoes of dot-com bubble “vendor financing” schemes, where an equipment maker would loan a customer money to buy its own gear. Today it plays out at a colossal scale among AI’s top companies.

To break it down, consider a few major flows in the current AI deal web:

Nvidia ↔ OpenAI: Nvidia supplies the GPUs that power OpenAI’s models, and has now pledged $100 B of investment into OpenAI. In effect, Nvidia will fund OpenAI, which will in turn spend much of that cash on Nvidia chips. (Nvidia also backed OpenAI in a $6.6 B round in late 2024.)

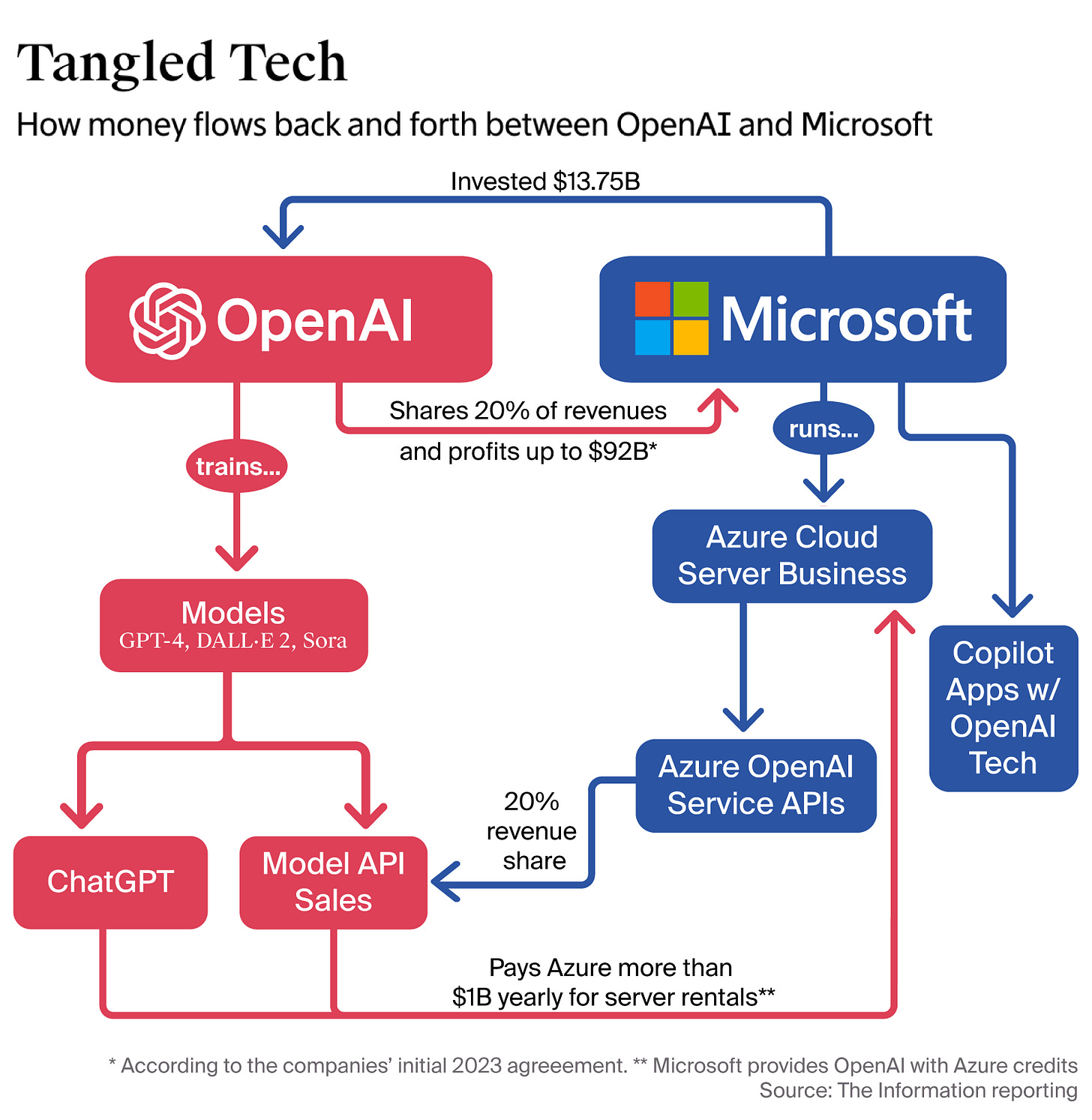

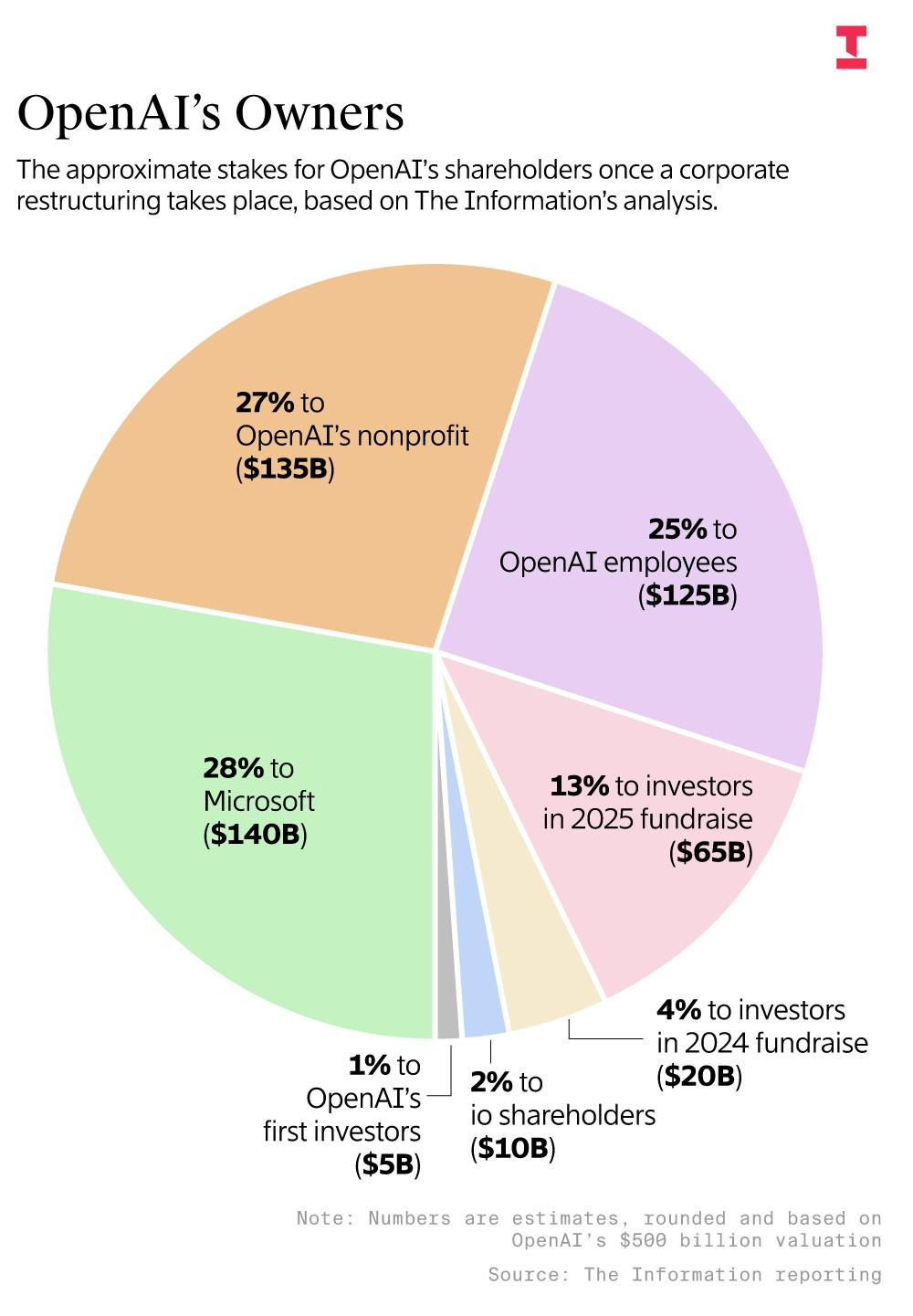

Microsoft ↔ OpenAI: Microsoft has likewise poured billions of dollars into OpenAI since 2019. OpenAI’s AI services run on Microsoft’s Azure cloud, and Microsoft shares in some of the revenue. Crucially, Microsoft is now both OpenAI’s largest investor and one of its biggest customers. (Microsoft does not fully break out the OpenAI-related sales in its reports, so analysts caution the gross figures may double-count some activity.)

Oracle ↔ OpenAI: Oracle is building a trillion-dollar data-center network (the “Stargate” project with Microsoft, SoftBank, etc.) to house AI workloads. Oracle supplies data-center space and services to OpenAI, while also buying Nvidia hardware for those centers. Morgan Stanley notes that Oracle even finances some capacity purchases through its vendors – often Nvidia itself – linking Oracle’s data-center business back into the Nvidia/OpenAI loop.

Nvidia ↔ CoreWeave ↔ Microsoft: Nvidia has invested in CoreWeave, a cloud GPU data-center operator, and in turn leases cloud capacity from CoreWeave for its own internal AI projects. CoreWeave rents GPU clusters to customers like Microsoft, so Nvidia’s money partly flows to CoreWeave, which then sells Nvidia hardware through Azure to Microsoft. Morgan Stanley estimates CoreWeave plans to spend over half of its $20 B+ capital budget on Nvidia kits, illustrating another feedback loop.

AMD ↔ OpenAI: Even AMD has a stake. Under a recent deal, OpenAI is deploying hundreds of thousands of AMD chips in its data centers, and AMD gave OpenAI $34 B in stock warrants as part of that agreement. This means OpenAI holds an option to buy a large share of AMD — making OpenAI a quasi-investor in one of its own chip vendors.

Taken together, these deals form a closed circuit of capital. Morgan Stanley’s note even visualizes it as an “AI economic web” where “each deal bolsters the next one.” Every dollar each company puts in seems to come back around through purchases or equity in others. As one Morgan Stanley strategist put it, “the AI economy…operates as its own feedback loop.”

2. Circular financing hides true demand

If revenue comes from your own investments, you can’t tell how much is organic. Morgan Stanley warns that AI demand may look stronger than it really is because “suppliers fund customers, share revenue, or hold equity stakes in each other.”

3. Nvidia sits at the center of the loop

It sells chips to OpenAI, invests in OpenAI, finances CoreWeave (which buys its chips), and leases compute back from CoreWeave. Every dollar seems to pass through Nvidia’s checkout counter at least once.

4. Microsoft’s exposure is deeper than it looks

OpenAI’s services run on Azure, which drives much of Microsoft’s AI growth. Yet the revenues are entangled—Microsoft is both investor and reseller. Morgan Stanley estimates OpenAI could represent all of Azure AI’s 2026 growth. But no one knows the real numbers; they’re buried in footnotes.

5. Oracle and SoftBank are building trillion-dollar infrastructure bets

Projects like Stargate aim to house the world’s AI compute. Oracle sells capacity to OpenAI while buying GPUs from Nvidia, financed partly by Nvidia itself. It’s a massive capital chain reaction built on assumed exponential demand.

6. AMD joined the party too

In 2025, AMD gave OpenAI $34 billion in stock warrants, effectively making OpenAI a shareholder in its own supplier. Even competitors are tying themselves into the same web.

7. The ghost of the dot-com bubble is back

Back then, telecom vendors loaned customers money to buy their own equipment—a practice called vendor financing. When demand slowed, the house of cards fell. Today’s “AI circular financing” rhymes with that playbook—only at a trillion-dollar scale.

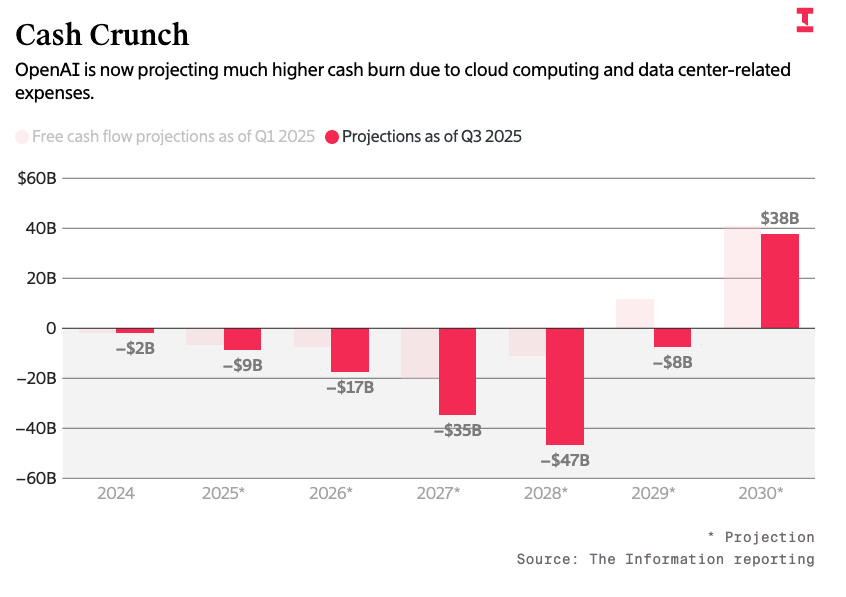

8. OpenAI’s losses highlight the risk

OpenAI reportedly lost $7.8 billion in the first half of 2025 on $4.3 billion in revenue, yet its valuation hit $500 billion. That mismatch works as long as everyone believes in infinite GPU demand. If not, the loop breaks.

9. The biggest risk isn’t fraud, it’s misallocation

If AI demand slows, companies could be left with idle data centers and prepaid chip orders. Morgan Stanley warns hyperscalers could face capital outlays with no returns. In simple terms: overbuilt infrastructure chasing imaginary growth.

10. The opportunity is still real, but know the mechanics

Circular financing is not inherently bad. It can accelerate innovation when real demand follows.

But as investors and founders, you need to know whether the growth you’re seeing comes from users—or from companies financing each other to keep the story going.

Final note:

I still think AI is the biggest opportunity since the internet, but it looks like OpenAI is having funding troubles and that’s why its resorting to circular financing.

Also, what this means is that Microsoft, Nvidia and Oracle win if OpenAI delivers in the end, so if OpenAI revenues continue growing, their stake might become more valuable than ever.

Nevertheless, if OpenAI doesn’t manage to become profitable, the bubble might burst and we might end up all running opensource models in our personal computers.

What do you think? Are we in a bubble?

Chers,

Guillermo

FAQs for “10 Things You Need to Understand About the AI Bubble”

1. Are we in an AI bubble like the Dot-Com era?

Many investors are drawing parallels between today’s AI boom and the dot-com bubble of the late 1990s. The signs—skyrocketing valuations, speculative funding, and self-reinforcing deal structures—suggest we might be in a similar cycle. However, unlike dot-com companies, today’s AI firms generate tangible products and infrastructure, which may prevent a full collapse.

2. What is “circular financing” in the AI industry?

Circular financing refers to companies investing in each other and then using that capital to buy each other’s products or services. For example, Nvidia invests in OpenAI, which then spends that money on Nvidia chips. This creates the illusion of high demand, even when it’s largely driven by internal capital recycling.

3. Why is circular financing risky for the AI economy?

Because it masks real demand. When companies fund their own customers, revenue growth can look impressive on paper—but it may not reflect actual market adoption. If external demand slows, the entire cycle can unwind quickly, leaving overbuilt infrastructure and heavy capital losses.

4. How does Nvidia benefit from the AI bubble?

Nvidia sits at the center of the AI ecosystem. It sells GPUs to OpenAI, CoreWeave, and Oracle—many of which it also invests in. As long as AI demand (real or circular) persists, Nvidia’s revenues soar. But if spending slows, the illusion of endless GPU demand could vanish fast.

5. What role does Microsoft play in AI’s circular financing?

Microsoft has invested billions in OpenAI and runs OpenAI’s models on its Azure cloud. Because Microsoft both funds and sells to OpenAI, its AI growth numbers can be inflated by the same circular mechanisms—making it hard to distinguish organic growth from internal deal flow.

6. Why are Oracle and SoftBank investing billions in AI data centers?

Oracle and SoftBank are betting on exponential AI demand through massive infrastructure projects like “Stargate.” These trillion-dollar data center builds depend on long-term AI growth forecasts. But much of their financing loops back through Nvidia and OpenAI, reinforcing the same circular ecosystem.

7. What’s the connection between AMD and OpenAI?

In 2025, AMD gave OpenAI $34 billion in stock warrants—essentially letting OpenAI become a shareholder in its own chip supplier. It’s another example of AI companies tying themselves together financially, increasing both collaboration and systemic risk.

8. How does this compare to the dot-com “vendor financing” problem?

In the dot-com bubble, telecom vendors lent money to customers to buy their own equipment—artificially inflating demand. When the market slowed, everything crashed. Today’s “AI circular financing” is similar, except it’s happening at a trillion-dollar scale among the world’s largest tech firms.

9. What happens if AI demand slows down?

If demand for AI compute or applications cools, companies could be left with billions in idle data centers and prepaid chip orders. Analysts warn this could trigger a sharp correction in AI valuations, similar to the telecom overbuild in the early 2000s.

10. Is the AI opportunity still real despite the bubble risk?

Yes. Circular financing can accelerate innovation and infrastructure readiness. But investors and founders must differentiate between synthetic growth and real user adoption. If OpenAI and others convert infrastructure into sustainable revenue, the winners—Microsoft, Nvidia, and Oracle—could see massive upside. If not, the market correction could be severe.

11. Why is OpenAI losing billions despite massive valuation growth?

OpenAI reportedly lost $7.8 billion in the first half of 2025 while being valued at $500 billion. This disconnect highlights how much investors are betting on future dominance rather than current profitability—a classic sign of speculative excess.

12. Could open-source AI models end the bubble?

If proprietary AI companies fail to sustain growth or profitability, developers may turn to open-source alternatives running on personal or local hardware. This could shift the AI economy from centralized giants to distributed innovation—deflating the current valuation bubble.

Most of the these companies also have customers outside of the circular structure. How do those revenues stack up and how fast are they growing?

It's certainly a lot of debt financing at a rather vast scale. Just like the impact of tariffs take a while to set in, there are deeper consequences for the AI infrastructure rush. I'm not always clear on who it is an opportunity for. Certainly people are making money off the FOMO in various ways including and mostly, the stock market.