Satya Nadella & Sam Almant: Inside the OpenAI–Microsoft Pact, OpenAI investment, the restructure, IPO, circular financing, layoffs, AGI full breakdown

The New Oil Is Compute: Inside the Partnership Powering the Next Decade of AI

Welcome to The AI Opportunity: be the first to learn about where tech is going to be impacting business.

Subscribe for premium access & email me at g@guillermoflor.com to Sponsor the Newsletter

Brad Gerstner just interviewed Sam Altman & Satya Nadella , probably the 2 most influential people in AI right now.

They talked about the initial OpenAI investment, the restructure, IPO, circular financing, layoffs, AGI and more.

So I decided to breakdown the whole interview into the most valuable points for investors and founders worldwide.

Enjoy!ª

PS: If you found this valuable I’d appreaciate a repost/share!

Best,

Guillermo

I. Opening and Personal Exchange

The conversation opens informally with camaraderie between Sam Altman and Satya Nadella, reflecting the deep bond of their partnership.

Sam mentions his newborn child; Satya gives fatherhood advice and notes the importance of cherishing the early years.

There’s light humor about Sam being passionate about “his baby and compute.”

II. Context: Historic Tech Week

Brad sets the macroeconomic and industry backdrop:

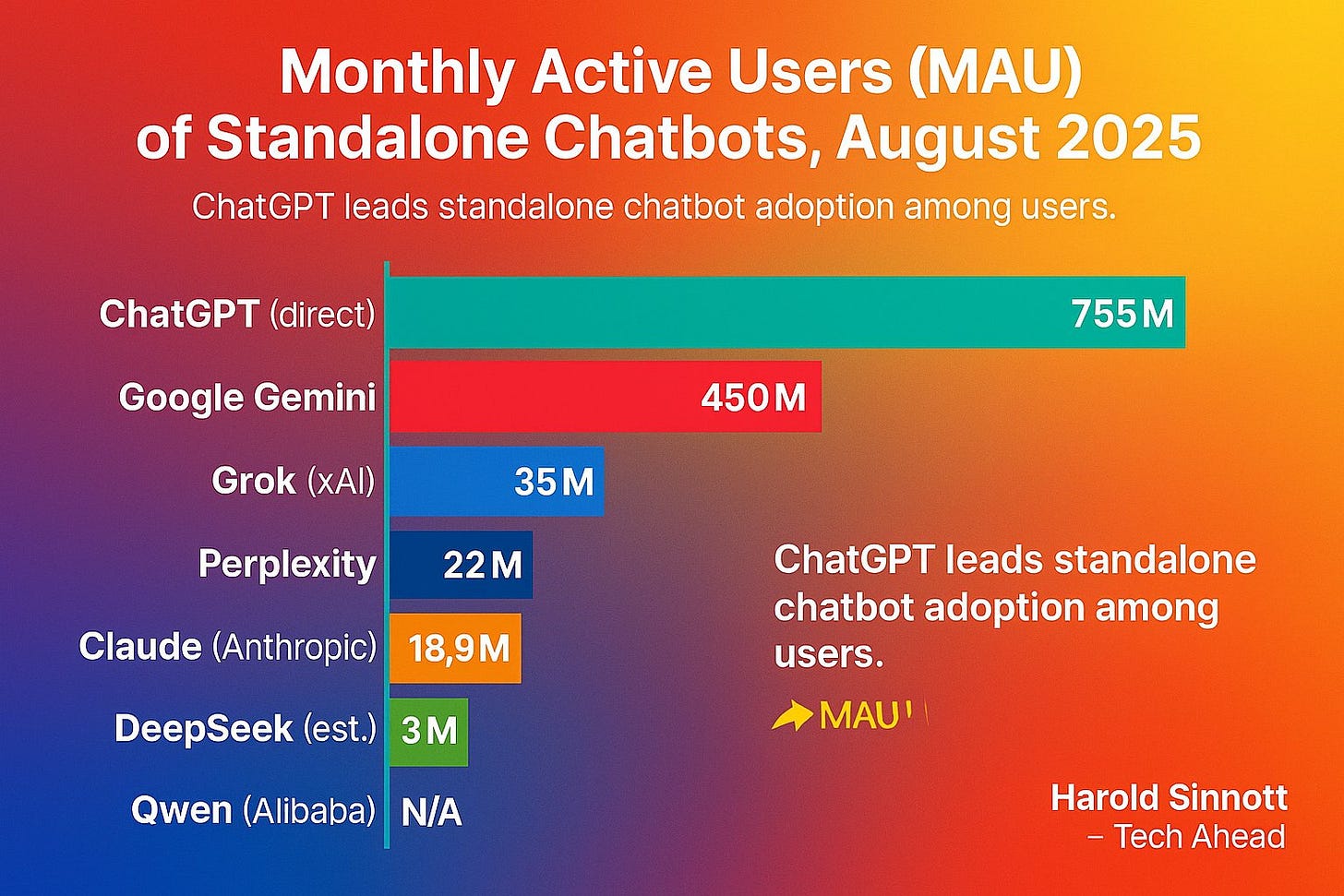

Nvidia reaches $5T market cap, alongside strong results from Google, Meta, and Microsoft.

Persistent complaint across industry: “not enough compute.”

U.S. macro: rate cuts, 4% GDP tracking, new trade deals across Asia fueling reindustrialization.

U.S. government commits $80B to nuclear fission, boosting AI-relevant energy capacity.

Leads into the announcement of Microsoft–OpenAI’s clarified partnership and restructuring.

III. Microsoft–OpenAI Deal Structure

A. Investment and Ownership

Microsoft has invested $13–14B since 2019.

Holds ~27% equity on a fully diluted basis (down from ~33% after dilution).

Nadella emphasizes pride not only in the investment but also in OpenAI’s nonprofit foundation, now one of the world’s largest.

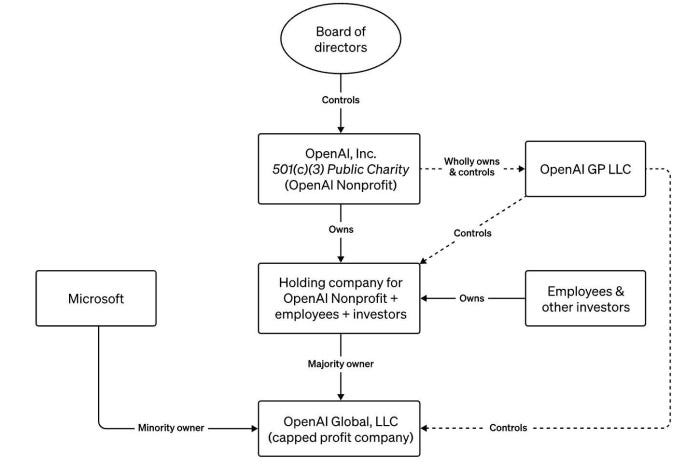

B. OpenAI’s Restructure

The new structure:

OpenAI Foundation (nonprofit) on top

Public Benefit Corporation (PBC) underneath.

Foundation already capitalized with $130B in OpenAI stock; potential to become “largest nonprofit ever.”

Mission: ensure AI benefits humanity, with first $25B directed to health, AI security, and resilience.

C. Altman on Purpose

Altman reiterates belief in capitalism and private enterprise as value creators, but adds that certain goals—like curing diseases, AI-driven science, and resilience research—require non-market approaches.

Wants the nonprofit to fund AI for scientific discovery and societal stability (cyber defense, safety research, economic adaptation).

IV. Partnership Terms (Microsoft–OpenAI)

A. Exclusivity

Azure holds exclusive rights to distribute OpenAI’s frontier models (e.g., GPT-4, GPT-5) until 2030–2032, or earlier if AGI is verified.

OpenAI can distribute open-source models (like Sora, Codex, agents) elsewhere.

Altman notes “stateless APIs” remain exclusive to Azure.

B. Revenue Sharing

Microsoft receives ~15% revenue share from OpenAI revenues until 2032 or AGI verification.

Estimated: if OpenAI earns $20B revenue, ~$3B flows to Microsoft.

Nadella confirms this rev share but is uncertain whether it’s booked under Azure.

C. AGI Clause

If OpenAI claims AGI, an independent expert panel (“jury”) decides verification.

Nadella downplays immediacy: “Nobody’s even close.”

Altman expects unexpected twists but praises having a process in place.

V. Growth, Revenue, and Compute Commitments

A. OpenAI’s Revenue and Spending

Reported revenue: ~$13B (Brad’s figure).

Altman clarifies it’s “well more than that.”

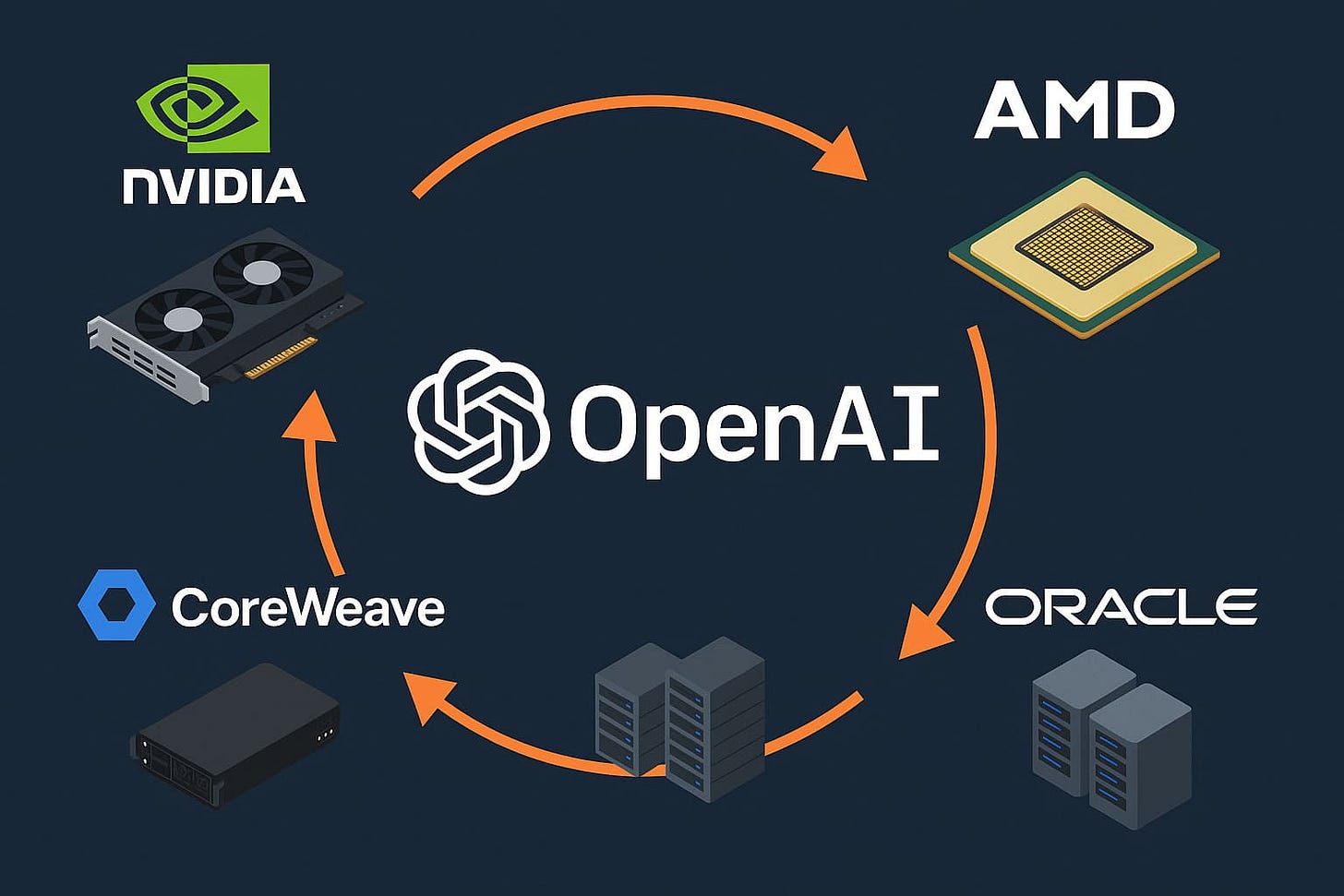

Plans $1.4T in compute commitments over 4–5 years:

$500B Nvidia

$300B AMD

$250B Azure

Remaining split across Oracle, others.

Dismisses market concerns, says demand and revenue growth justify the scale.

B. Nadella on Execution

Says every OpenAI business plan “has been beaten.”

Praises execution, productization, and business discipline.

C. Compute Constraints

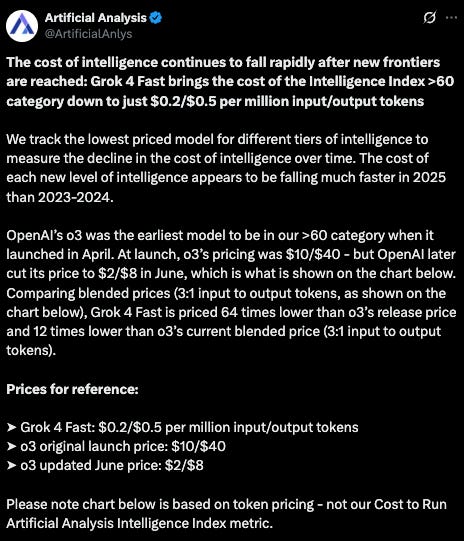

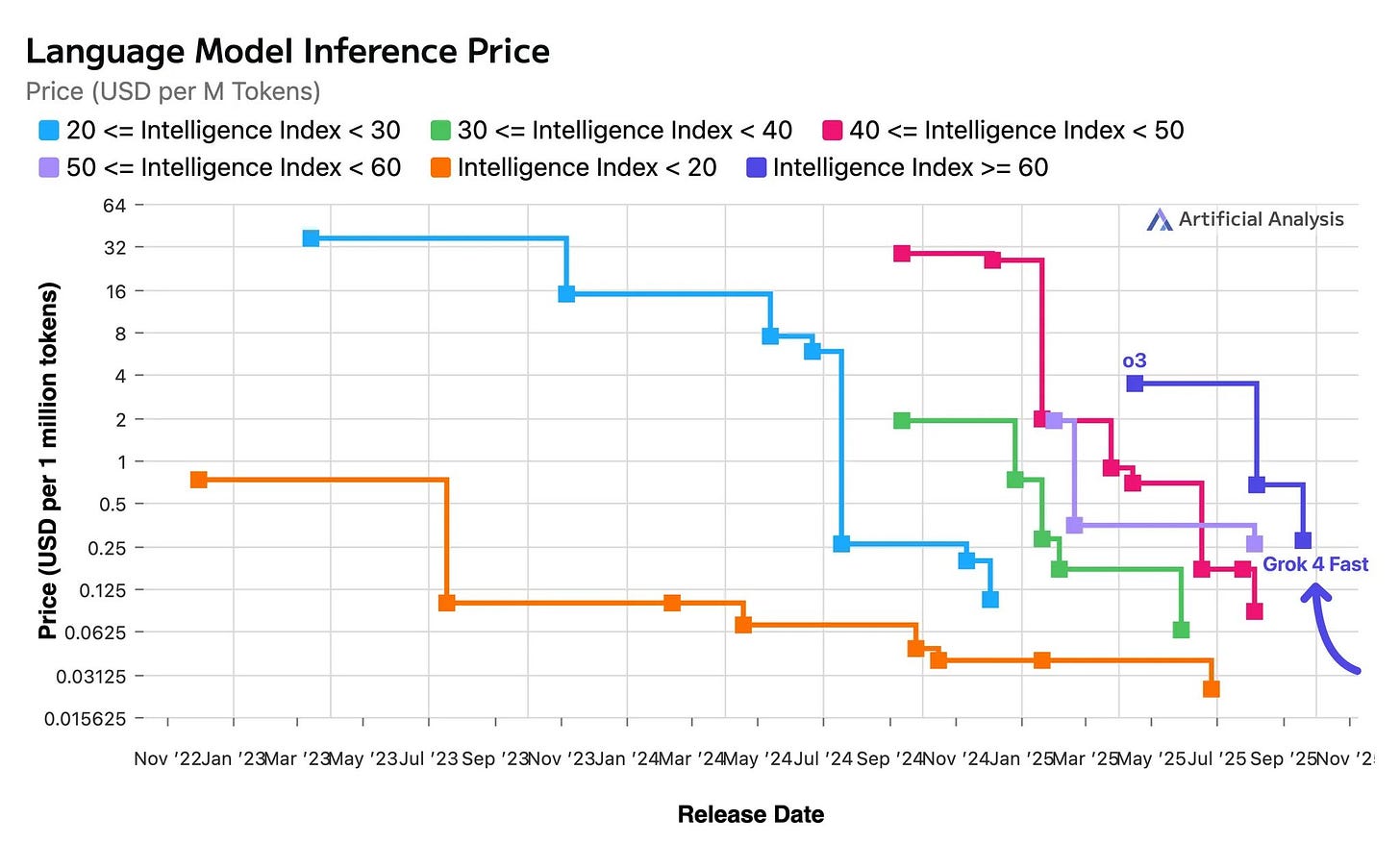

Both confirm massive compute bottlenecks limiting growth.

Altman compares compute to energy: demand elasticity depends on price.

If compute price drops 100x, usage would increase >100x.

Models growing smarter drive new willingness to pay.

Nadella cites “tokens per dollar per watt” as key metric—intelligence as new GDP driver.

D. Supply Chain and Power Issues

Nadella says main bottleneck now is power access, not chip supply.

Mentions idle GPUs due to lack of data-center capacity.

Predicts non-linear cycles—temporary gluts will occur later.

Altman warns of future AI infrastructure bubble bursts as costs fall sharply.

VI. Future Devices and Local Compute

Altman envisions consumer devices running GPT-5/6 locally.

Nadella emphasizes a “fungible fleet” across training/inference tasks for cloud efficiency.

Both highlight edge inference and new hardware form factors (e.g., wearable agents).

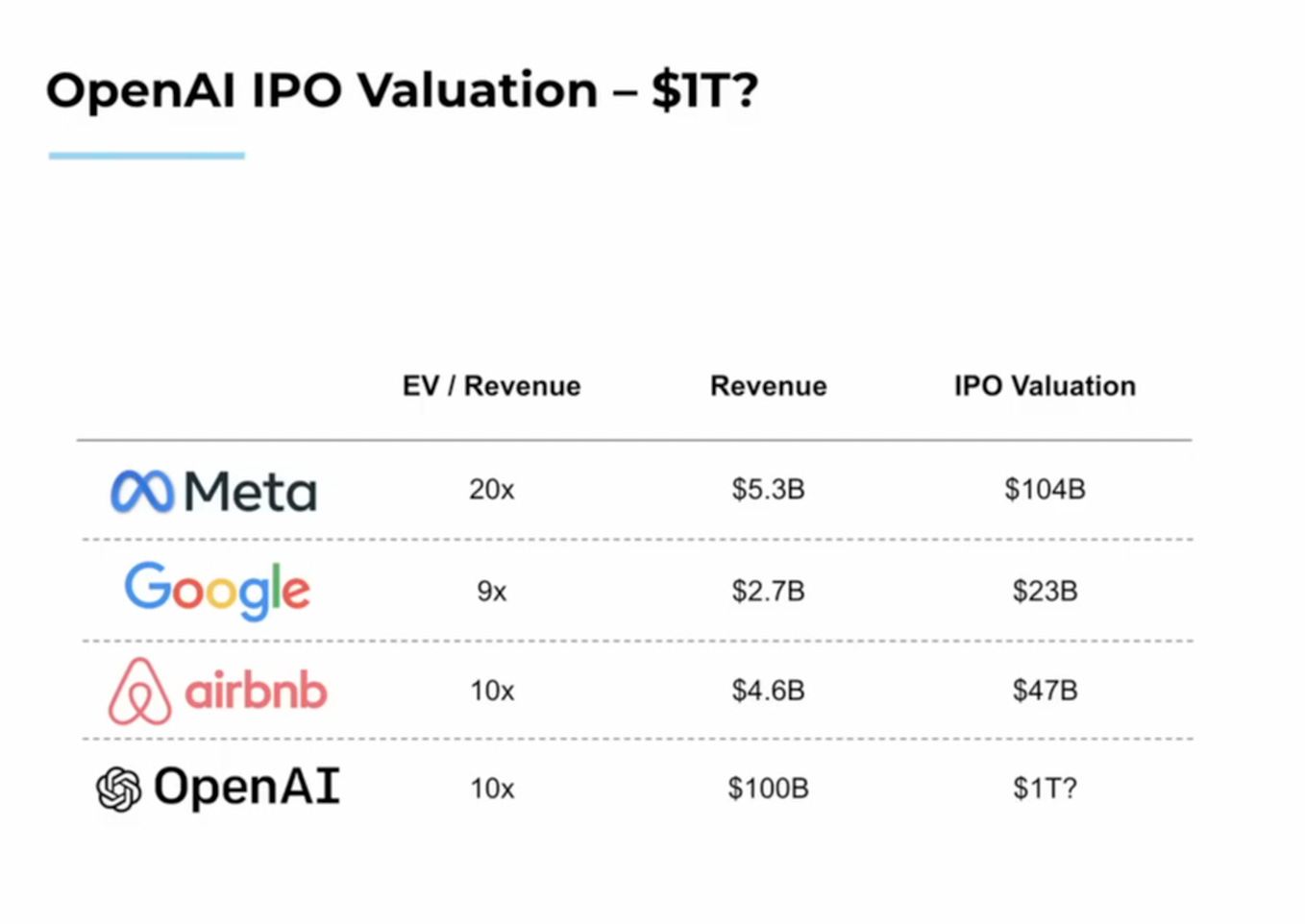

VII. IPO and Valuation Speculation

Rumors: OpenAI may go public in 2026–2027.

Altman denies concrete plans but expects it “someday.”

Brad notes possible $100B+ revenue by 2028–29, implying $1T valuation.

Altman says he prefers funding growth via revenue, not IPO, but likes idea of retail investors owning OpenAI.

VIII. Regulation and Policy

Discussion of U.S. AI regulation:

Federal preemption removed from Senate bill—creates 50-state patchwork (e.g., Colorado AI Act).

Altman: “I don’t know how we’re supposed to comply.”

Calls it a “big mistake.”Nadella: federal framework essential; startups will struggle otherwise.

Both warn that EU-style overregulation would hurt competitiveness.

IX. Future of AI (2026 and Beyond)

A. Altman’s Vision

AI-driven science: expects first small discoveries by 2026.

Coding agents (Codex) evolving from multi-hour to multi-day autonomous workflows.

Robotics and specialized compute next frontiers.

Defines success as AI expanding human knowledge — “superintelligence” as discovery.

B. Nadella’s View

Compares moment to ChatGPT’s UI revolution.

Predicts new interface paradigm: macro-delegation and micro-steering.

AI as continuous assistant integrated across devices and workflows.

Consumer agents will automate mundane tasks—“personal assistant for everyone.”

X. Microsoft’s Original Investment (2019)

Nadella recounts:

Microsoft interested since 2016 (Dota2, RL).

2019: Sam pitches transformers and scaling laws → perfect alignment with Microsoft’s NLP focus.

Faced board skepticism; Bill Gates initially doubted but changed mind after GPT-4 demo.

Early GitHub Copilot results validated thesis.

Defines 2019 partnership as inflection moment for AI era.

XI. Strategic Value of the Partnership

Beyond equity, Microsoft gains:

Exclusive frontier model access.

Royalty-free IP rights for 7 more years.

Cross-product embedding (Copilots, M365, GitHub, Security, Health).

Azure customer migration from AWS.

Nadella: “We have a frontier model for free.”

Partnership created world’s largest suite of AI products:

GitHub Copilot, ChatGPT, Microsoft 365 Copilot, and Security Copilot.

XII. Financial Impact and Market Perception

Microsoft consolidates $4B quarterly losses from OpenAI.

Nadella argues true value lies in Azure growth and ecosystem pull.

13.5B max risk vs. 130B+ equity stake potential.

Azure up 39% YoY (93B run rate), would have been 41–42% with more compute.

Critics misread losses as negative; he calls for transparency but emphasizes long-term upside.

XIII. Infrastructure Strategy and Competition

Microsoft now power-constrained, not chip-constrained.

Focus: fungible fleet across generations (H200 → H300).

Avoids single-customer lock-in (even OpenAI).

Balances own 1P demand (Copilots) with 3P customers.

Competitors:

Oracle, CoreWeave, Crusoe entering compute race.

Nadella: only three true hyperscalers due to operational know-how.

Says Microsoft’s scale efficiency ensures margins remain strong despite competition.

XIV. “Circular Financing” Question

Brad raises concerns about circular AI deals (credits, equity swaps, vendor financing).

Nadella clarifies Microsoft’s $13.5B was equity, not booked as revenue.

Notes “vendor financing” is common; sustainability depends on real end-demand.

XV. Software, Agents, and the Future of SaaS

A. Agentic Architecture

Nadella: AI replacing traditional SaaS logic layer.

Old stack: tightly coupled data + logic + UI.

New stack: decoupled agent layer mediating between them.

Microsoft’s edge: low-ARPU, high-usage base (M365, Teams, GitHub) → ideal for grounding agents.

AI increases document creation, chats, code → strengthens graph data.

B. Business Model Shift

Future SaaS: “agents are the new seats.”

Enterprises move to consumption-based agent models; consumer monetization less clear.

GitHub Copilot example: auto-mode dynamically selects models based on task feedback.

XVI. Search and Consumer Economics

Brad compares search economics (cheap, ad-based) vs. chat economics (GPU-heavy).

Nadella: search index had fixed costs; chat has ongoing inference cost per query.

Predicts ad models evolve; early monetization through subscriptions (premium Copilot).

Consumer space constrained by time and attention; enterprise AI has clearer ROI.

XVII. Jobs, Productivity, and Workforce

Topic: layoffs and AI’s job impact.

Nadella: sees AI as productivity amplifier, not job destroyer.

Internal example: engineer automating DevOps pipeline with agents → huge efficiency gain.

Future: headcount grows with higher leverage per employee.

“We must relearn how to work with agents.”

Predicts new workflows → golden age of margin expansion and productivity.

XVIII. Reindustrialization of America

Brad and Satya discuss AI-driven U.S. manufacturing revival:

$4T capex across Big Tech = 10× Manhattan Project.

U.S. trade diplomacy attracting trillions in foreign investment (S. Korea, Japan, etc.).

Power, grid, and supply chain capacity central to reindustrialization.

Microsoft’s Wisconsin data center cited as local economic driver.

Nadella emphasizes U.S. hyperscalers export “compute factories” globally—America as engine of global AI infrastructure.

XIX. Closing Remarks

Mutual admiration between all participants.

Gerstner concludes with optimism:

4% U.S. GDP growth,

alignment between Washington and Silicon Valley,

“AI-led reindustrialization of America.”

Nadella and Altman sign off; both optimistic about long-term coordination and progress.

FAQ: The AI Opportunity — Microsoft, OpenAI & the New Era of Compute

1. What is the new structure of the Microsoft–OpenAI partnership?

The partnership now operates under a dual structure: the OpenAI Foundation (nonprofit) sits above the OpenAI Public Benefit Corporation (PBC). Microsoft retains roughly 27% equity and exclusive distribution rights for OpenAI’s frontier models (GPT-4, GPT-5, and beyond) through Azure until 2032.

2. Why did OpenAI create a nonprofit foundation?

Sam Altman’s goal is to ensure AI benefits all of humanity. The OpenAI Foundation will fund long-term projects in AI safety, healthcare, cyber defense, and scientific discovery, backed by an initial $130B in OpenAI stock — potentially making it the largest nonprofit in the world.

3. How much has Microsoft invested in OpenAI?

Microsoft has invested approximately $13–14 billion since 2019, translating into a 27% ownership stake. The deal gives Microsoft both strategic and financial upside, alongside exclusive access to OpenAI’s frontier model APIs.

4. How does the revenue sharing between Microsoft and OpenAI work?

Under the current terms, Microsoft receives about 15% of OpenAI’s revenue until either 2032 or when AGI (Artificial General Intelligence) is independently verified. This could represent billions in revenue flow if OpenAI continues its rapid growth.

5. What happens if OpenAI reaches AGI?

If OpenAI declares AGI, a third-party expert jury must verify the claim. At that point, key exclusivity and revenue-sharing clauses with Microsoft would be reevaluated or expire.

6. How large is OpenAI’s compute commitment?

OpenAI has committed roughly $1.4 trillion in compute spending over the next 4–5 years — including $500B to Nvidia, $300B to AMD, and $250B to Microsoft Azure. This underscores the scale of demand for AI infrastructure globally.

7. Why is compute considered the new oil in AI?

Both Sam Altman and Satya Nadella describe compute as the new economic backbone — similar to energy in the industrial era. As models get smarter, demand for compute grows exponentially. “Tokens per dollar per watt” is emerging as the new metric for productivity.

8. What are the main bottlenecks in AI growth today?

The key constraint is power and data-center capacity, not chips. Even with abundant GPUs, the lack of electricity and cooling infrastructure limits AI scaling. Nadella predicts temporary compute gluts, followed by rapid expansions as new facilities come online.

9. Will OpenAI or Microsoft go public soon?

Altman denies imminent IPO plans but acknowledges it may happen “someday.” Analysts speculate a $1T+ valuation could be possible by 2028–29, with OpenAI’s revenues potentially exceeding $100B. Microsoft benefits either way due to its ownership and Azure exclusivity.

10. How is AI reshaping the software and SaaS business model?

The traditional SaaS model (data + logic + UI) is being replaced by agentic architectures, where AI agents handle logic and workflows autonomously. Nadella predicts “agents are the new seats”, moving enterprise software toward usage-based pricing tied to agent productivity.

11. What is the economic impact of the AI–led reindustrialization of America?

AI infrastructure investment — estimated at $4 trillion across U.S. hyperscalers — is driving a new wave of manufacturing, energy, and data-center growth. This mirrors a digital-era version of the Manhattan Project, with America re-emerging as the world’s compute exporter.

12. What does this mean for founders and investors?

For startups and VCs, the partnership signals:

Compute and power markets as long-term investment frontiers.

Agentic software as the next SaaS wave.

A policy tailwind around U.S. AI competitiveness and reindustrialization.

Early opportunity in AI infrastructure, safety tools, and applied research ecosystems.

13. How might regulation affect AI innovation in the U.S.?

Both Altman and Nadella warn that state-by-state AI laws (like Colorado’s) could create chaos for startups. They advocate for a federal framework to preserve innovation while ensuring responsible AI use — avoiding EU-style overregulation that could stall growth.

14. What’s next for AI in 2026 and beyond?

Expect breakthroughs in:

AI-driven science and autonomous discovery.

Coding agents capable of multi-day workflows.

Wearable and edge AI devices running local GPT-6 models.

A new UI paradigm combining macro-delegation (agents act) with micro-steering (humans guide).