That line, dropped by Guy Kawasaki, Apple Evangelist, in a Stanford canteen in 1999, is the moment Creandum really starts.

A young McKinsey consultant from Norway, Staffan Helgesson, is sitting there in full corporate uniform: dark suit, white shirt, tie. Kawasaki looks at him and the other Europeans and says:

“Guys, just so you know, here in the Valley only bus drivers wear ties.”

In the coffee break, Staffan and his colleagues literally tear their ties off. It’s a joke on the surface, but it lands like a small crisis: he realises he is “working for the losers of tomorrow”.

Sponsor The AI Opportunity & get your product in front of thousands of founders worldwide? Reach out to g@guillermoflor.com

Trending right now: The Data Room Template VCs love, 27 Most Promising AI Startup Pitch Decks Backed by Top Investors in 2025

Creandum Today

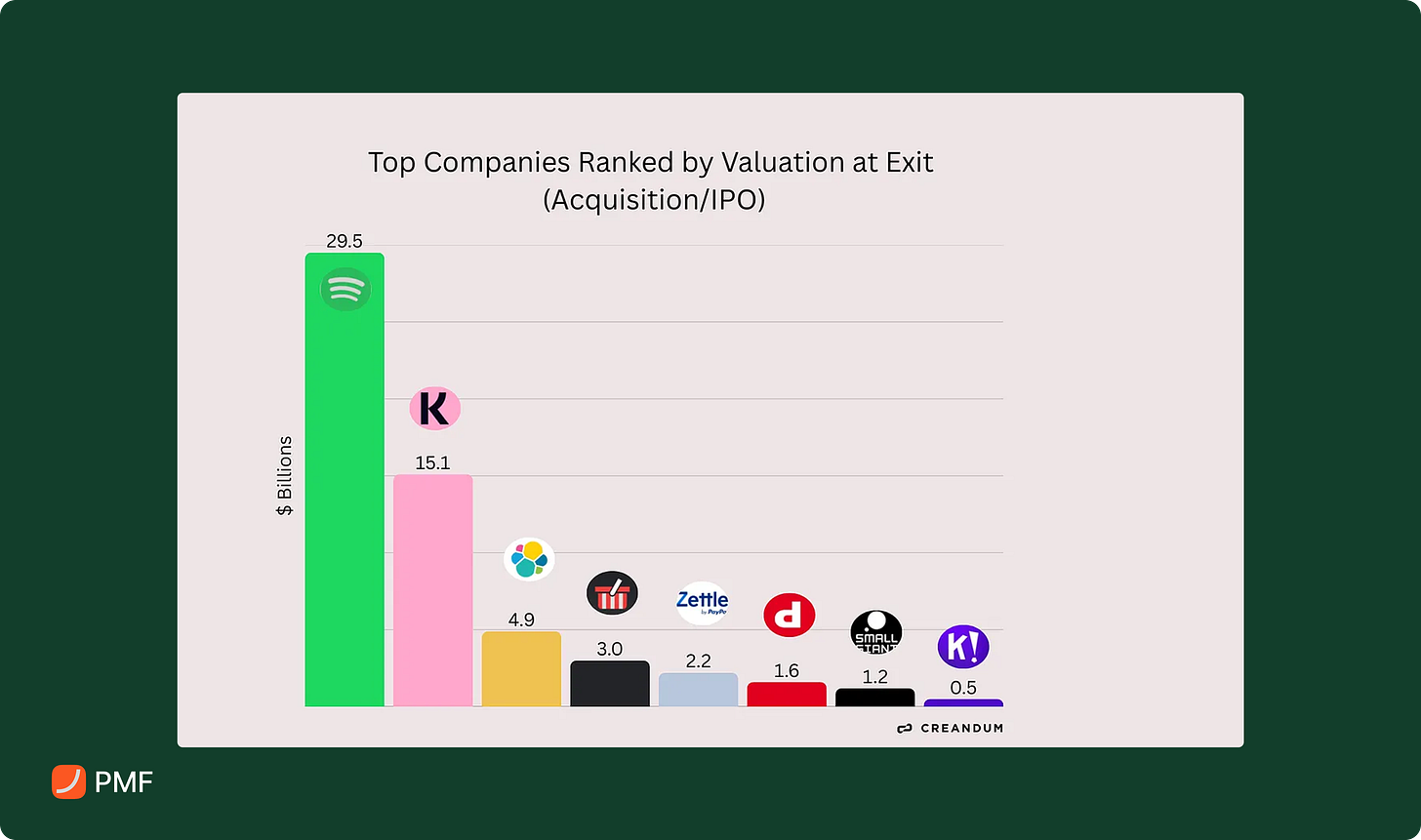

Creandum today manages around $2.2B, has raised about €1.6B across seven funds, and has backed roughly 172 companies, with 117 still active and 54 exited (Assets Under Management: $2.2b). Around 24 of those have reached unicorn status, 19 in Europe alone, including Bolt, Klarna, Spotify, Trade Republic, Factorial, Kahoot!, Depop, Lovable and others.

44 investments are in Sweden; the firm never abandoned its Nordic roots even as it went pan-European and then global.

Its LP base reads like a map of institutional capital in Europe and beyond: AP1, AP4, AP6, Industriens Pension, Tesi, KLP, MIT Basic Retirement Plan, Argentum Asset Management, EIF, Migdal, TTCP, Alaska Permanent Fund, Vintage, Swedish Venture Initiative, Skandia and more.

The through-line from Fund I to Fund VII is not geography or sector. It is a way of doing venture: product-obsessed, willing to do heavy structural work when a great company is “uninvestable”, and comfortable backing founders in markets everyone else has written off as dead.

Below the full story!

What this article includes

A full origin story: the exact cultural moment that triggered Creandum’s creation.

Creandum in numbers: AUM, funds, unicorn count, portfolio stats, LP map.

3 character-driven founder/partner profiles explaining why Creandum behaves the way it does.

A fund-by-fund timeline (I → VII) showing how their strategy scaled with Europe’s credibility.

8+ deep case studies (Cint, Spotify, Small Giant, Klarna, Cornershop, Depop, Trade Republic, Bolt, Monta, Lovable).

The “uninvestable → franchise” pattern (cap table surgery, blocked exits, dead industries).

A distilled Creandum playbook you can steal as a founder or investor: what they optimize for, and what they refuse to believe

Enjoy :)